If both spouses do not agree on the settlement of assets and debts, then the court will decide on an equitable division.

How do I go about getting my spouse's name off of the deed to the house?Ī: If both spouses agree to the terms of a divorce settlement, a quitclaim deed is the fastest, easiest and least expensive way to remove your spouse's name from the deed to the property. My Father is getting a reverse mortgage on his home, to get a lump sum, to pay-off my mortgage in full. We own a home together and both our names are on the deed itself and the mortgage. My spouse just stated that he wants a divorce. Q: When do I get my spouses' name off the house deed and mortgage? The portion of the property that each of you would get depends upon state law and on other evidence presented to the court regarding your financial situation.

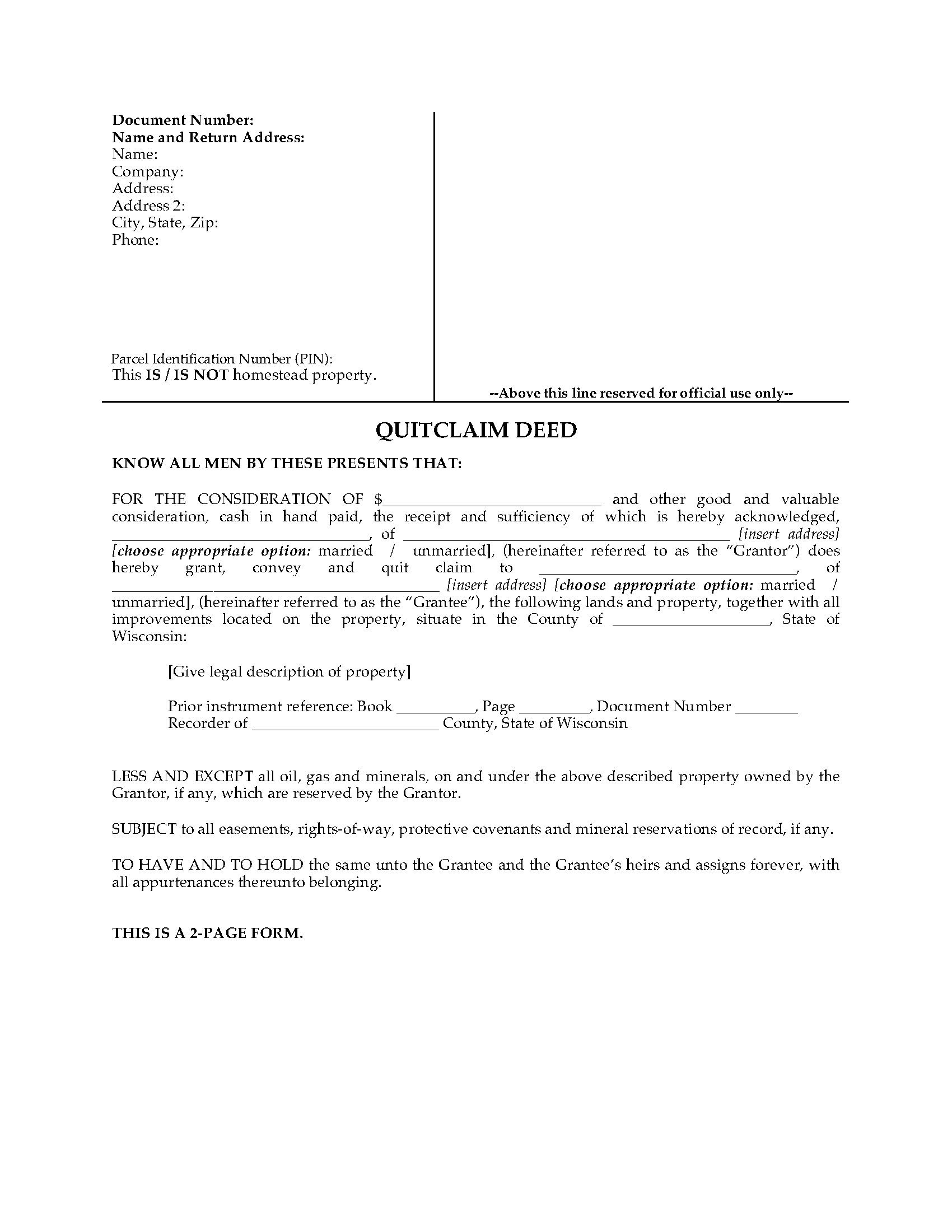

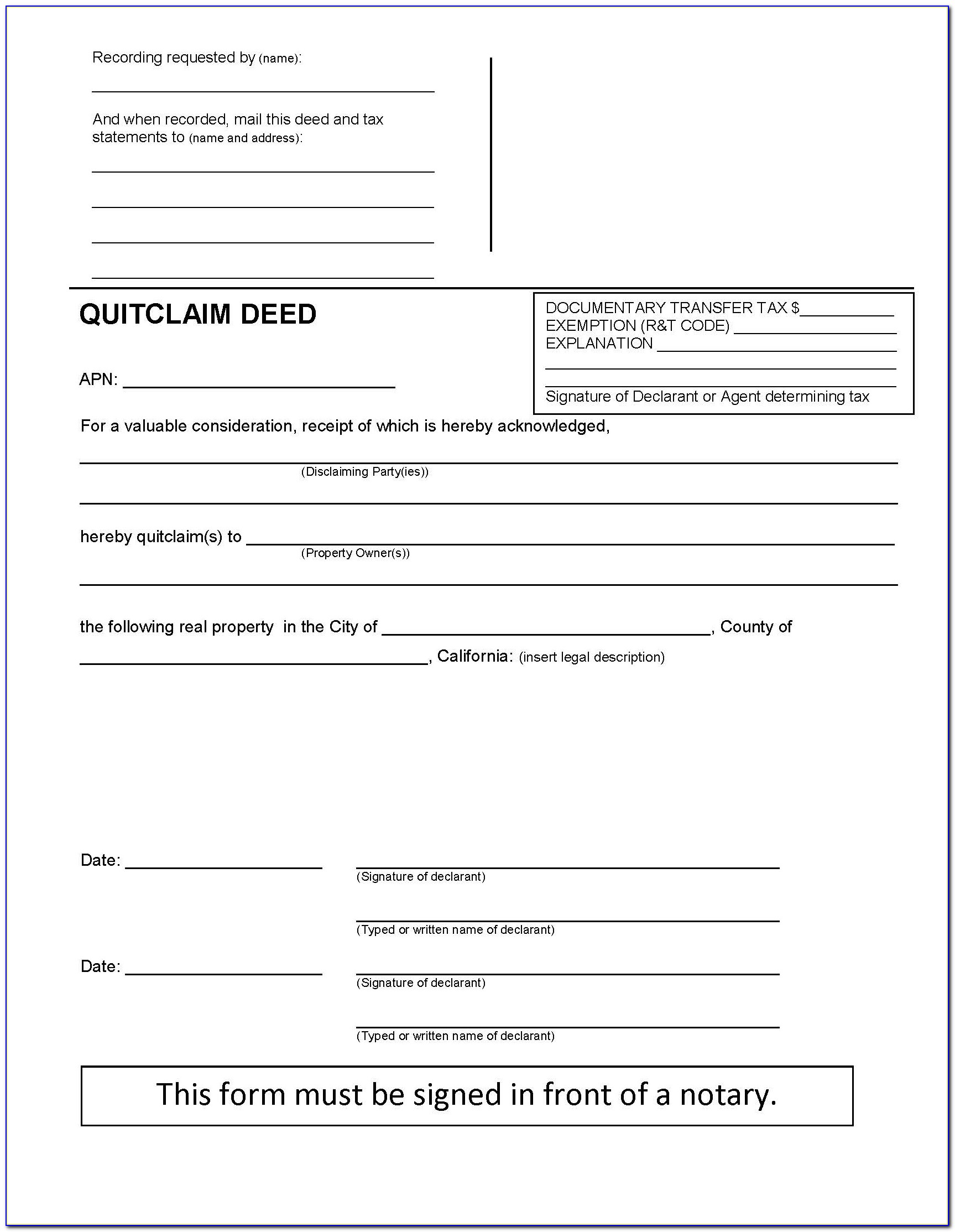

How would the judge decide to divide the equity in my home if I were to divorce?Ī: Any property that was purchased during marriage is considered community or marital property. I have always been the main provider for the family, but am worried that in the divorce settlement he will be able to sue for half of the equity in my house. My spouse quit claimed the house to me in order to get it mortgaged since he was not employed at the time. Q: Is my spouse entitled to any equity if he quit claimed the home to me? This can only mean that you have the sole responsibility of paying the mortgage and yet he co-owns the house with you. What can I do?Ī: It is unusual to have both your names both on the deed and yet only your name on the mortgage. The mortgage for our house was originated in my name only to get a better interest rate, but both our names are listed on the deed. Q: When do I get my spouse's name off the deed and mortgage? You are still responsible to pay for all the joint debts regardless of the division of property during your divorce. It has no effect on the debts or loan obligations of both husband and wife. Am I still liable for this debt, or did the quitclaim deed release my responsibility?Ī: A quitclaim deeds affects only how the property is titled. My ex has failed to meet his financial obligations and the mortgage company is pursuing me. We held equity loans on two separate properties and during our divorce, each property was signed off to its respective owner using a quitclaim deed. Q: Will a quitclaim deed release me from the mortgage obligation?

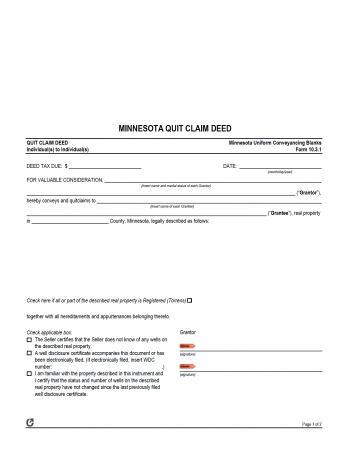

Consult a lawyer with any questions related to quitclaim deeds or other real property transfers.A quitclaim deeds affects only how the property is titled. Minnesota requires an electronic certificate of real estate value and a well disclosure statement for all sales of real property.Įnsure the deed meets document recording standards ( 507.093) before submitting to the recorder's office (or registrar's office, for Torrens land). A state deed tax, the amount of which is cited on the face of the deed is levied on the amount of consideration made for the transfer, and must be paid before the deed can be recorded. All grantors or grantors' authorized representatives and joining spouses must sign the deed. Requirements of the form include the names and marital status of each grantor and grantee and a complete legal description of the property subject to transfer. For this reason, the quitclaim deed is often used in divorce or other transactions between family members. A quitclaim deed contains no warranties of title. The deed conveys to the named grantee "all right, title, and interest of the grantor in the premises described," and does not extend to any after-acquired title ( 507.07). The quitclaim deed from individual to individual (Minnesota Conveyancing Blanks Form 10.3.1) is "sufficient to pass all the estate which the grantor could convey by deed of bargain and sale" in Minnesota (Minn.

0 kommentar(er)

0 kommentar(er)