Once he freezes his credit, then scammers can never open an account in his name. The owner of a small business industry can immediately freeze his credit if he finds himself a victim of a financial data breach.

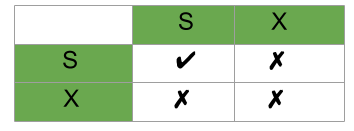

For all the small business owners, as their business grows, the necessity of protecting their credit reports from theft or scammers increases. Credit lock and credit freeze are new technologies that are essential for all the finance industries. Small business owners always have to be careful regarding the protection of their credit reports. To freeze and unfreeze credit reports is complex, and it may take more steps and time. To lock and unlock credit reports is a simple process. Then you have to call the credit bureaus or go online and follow all the procedures you have to generate a PIN to freeze or unfreeze your credit report. To activate or deactivate credit freeze, first, you need to mail your request to credit bureaus. You can easily activate and deactivate credit locks online or by using an app on your smartphone with username and password. It is protected by Personal Identification Number(PIN).Ĭredit lock is used as a preventive measure to safeguard a credit file.Ĭredit freeze is used when you get to know that all your personal information is being stolen by scammers. It is protected by username and password. The fundamental differences between these two systems are mentioned below:. Though these two systems are similar, there are certain differences between a credit lock and a credit freeze. Credit Freeze Vs Credit LockĬredit lock and credit freeze are the preventive measures to protect credit report information. Difference Between Credit Lock And Credit Freeze 4. By using a personal identification number (PIN) or password, you can easily freeze and unfreeze your credit reports whenever you want. With this, lenders cannot access your credit reports until you permit three credit bureaus to unfreeze the reports. It is a good option for every individual to freeze their credit reports. A credit freeze will restrict access to your credit report from scammers and help you identify any theft. Credit locks and credit freezes are similar, they prevent lenders from accessing an individual’s credit report without their consent. What Is A Credit Freeze?Ī credit freeze is also known as a security freeze at no cost. With just a user ID and password, smartphone users can manage the credit lock through an app.

LOCK VS ZE CREDIT HOW TO

All the reputed credit bureaus will help you to know how to place a credit lock. If scammers unknowingly open a credit report account using your name, the credit lock will protect you. It enables you to lock and unlock your credit report through your mobile without having to remember the card PIN.

What Is Credit Lock?Ī credit lock is a way to restrict lenders from accessing credit reports. The best way to protect your credit report is by signing up for either a credit lock or a credit freeze. So, you need to know how to protect your credit reports. Some scammers might also open loans in your name and not pay them back, and that will show up in the credit reports. Difference Between Credit Lock And Credit Freeze.Īre you worried thinking about scammers who can access your credit file without your permission? Scammers may easily open your credit file and start purchasing in your name, leaving you in debt in the credit reports. Credit Freeze Vs Lock: Which One is a Better Choice? 1. Credit Lock Vs Credit Freeze- How's It Helpful for Small Business Owners?Ĩ. Difference Between Credit Lock And Credit Freeze.ĥ.

0 kommentar(er)

0 kommentar(er)